From the NYT

Sunday, 29 September 2013

Sunday, 15 September 2013

The Cleveland Financial Stress Index

A new coincident indicator of financial stress.

"The level of the Cleveland Financial Stress Index (CFSI) has decreased in the past few months, indicating a lower level of systemic financial stress. Although the most recent reading of the index from September 4 is in Grade 2 or a “normal stress period,” the index had been in a Grade 1 or “low stress period” for 49 days since June 1. The index currently stands at −0.43, which is up 0.63 points from a recent low on July 15, 2013. (The points refer to the standardized distance from the mean or the z-score). The index is down 1.32 points over the past year and is 3.52 points lower than its historical peak in December 2008."

"The level of the Cleveland Financial Stress Index (CFSI) has decreased in the past few months, indicating a lower level of systemic financial stress. Although the most recent reading of the index from September 4 is in Grade 2 or a “normal stress period,” the index had been in a Grade 1 or “low stress period” for 49 days since June 1. The index currently stands at −0.43, which is up 0.63 points from a recent low on July 15, 2013. (The points refer to the standardized distance from the mean or the z-score). The index is down 1.32 points over the past year and is 3.52 points lower than its historical peak in December 2008."

Check out how this indicator moved into the Grade 4 category in late 2007, and remained in upper Grade 3 or Grade 4 throughout most of 2008.

Saturday, 3 August 2013

Stock Market Capitalization to GDP

Stock market capitalization to GDP has been called by some as the best measure of a stock market's valuation (see here)and (here). The market capitalization to GDP ratio is calculated by dividing stock market capitalization by GDP and multiplying the result by 100. This measure can be thought of as an economy wide price to sales ratio. Higher values indicate higher valuations. In general, values over 100 are indicative of over valuations. Lower values indicate lower valuations, but there is considerable disagreement as to what values represent undervaluation in today's environment.

Here is how this ratio compares across time for the United States. While many charts use S&P 500 market cap in the calculation, I have used a more broader measure (non financial corporate business: corporate equity, liabilities) obtained from the Federal Reserve. Notice how the ratio tends to peak before recessions. It wasn't until 1999 that market capitalization to GDP broke above 100% but since that time, it has averaged at a higher value than in the pre 1999 time period. Over the last 10 years, undervaluation seems to occur somewhere in the 60% to 80% range. In any case, the current value is high in an historical context, suggesting that at least from the perspective of this measure, the US stock market is approaching overvalued territory.

Here is a heat map showing stock market capitalization to GDP for a variety of countries. The data are from the World Bank online data base. The most recent measures show that Canada, the United States, England, Sweden, Switzerland, Chile, Malaysia, Thailand, and South Africa are all overvalued. Rewind the slider scroll bar back to 1988 and push play to see how this ratio changes across time.

Market capitalization of listed companies (% of GDP)

Here is how this ratio compares across time for the United States. While many charts use S&P 500 market cap in the calculation, I have used a more broader measure (non financial corporate business: corporate equity, liabilities) obtained from the Federal Reserve. Notice how the ratio tends to peak before recessions. It wasn't until 1999 that market capitalization to GDP broke above 100% but since that time, it has averaged at a higher value than in the pre 1999 time period. Over the last 10 years, undervaluation seems to occur somewhere in the 60% to 80% range. In any case, the current value is high in an historical context, suggesting that at least from the perspective of this measure, the US stock market is approaching overvalued territory.

Here is a heat map showing stock market capitalization to GDP for a variety of countries. The data are from the World Bank online data base. The most recent measures show that Canada, the United States, England, Sweden, Switzerland, Chile, Malaysia, Thailand, and South Africa are all overvalued. Rewind the slider scroll bar back to 1988 and push play to see how this ratio changes across time.

Market capitalization of listed companies (% of GDP)

Wednesday, 31 July 2013

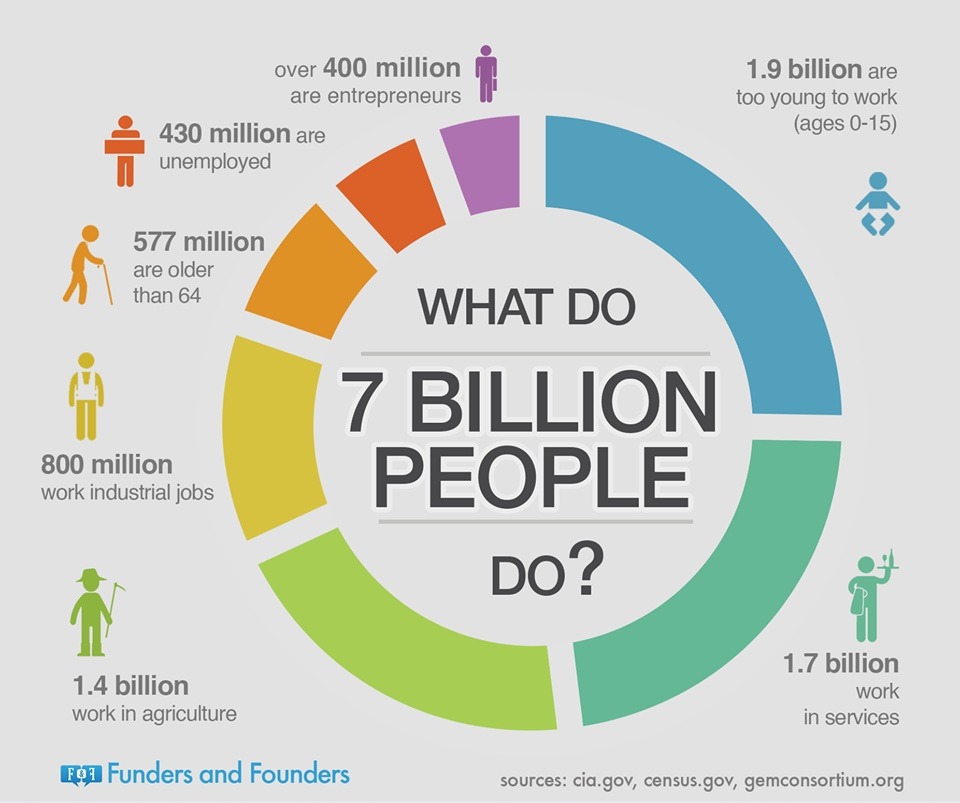

The "What Do 7 Billion People Do" Chart

The majority of the global work force works in services. There are fewer entrepreneurs than unemployed.

Saturday, 29 June 2013

Canadian REITs and Interest Rates

The past 2 months have been very difficult for Canadian investors. First interest rate worries spooked the banks and REITs, then weak commodity markets torpedoed the resources sector. Gold, the precious metal that is the go-to investment in times of inflation and worry is now trading at a 2 year low. Most recently, Canadian telecoms got whacked on news that Verizon was thinking of moving into Canada.

Real estate investment trusts (REITs) have been good investments for a long time. REITs pay bond size dividends and offer the opportunity for equity like price appreciation. REITs have been so good for so long, that many investors have a sizable portion of their investment portfolio in REITs.

To find out more about what has been happening with REITs, I decided to analyze how sensitive one of Canada's biggest REIT ETFs, the iShares capped REIT index (XRE) is to movements in interest rates.

Here is how XRE has performed since 2008.

The last recession was hard on XRE, but recovery came quickly.

Here is how Canadian 3 month T-bills and 10 year government bonds have performed. It seems reasonable to expect that REITs are negatively correlated with T-bill or bond yields, since increases in fixed income yields offer competitive less risky alternatives to investing in REITs. These falling yields have helped push the price of XRE higher.

I collected monthly data on XRE, 90 day T-bill yields, and the yield on 10 year government of Canada bonds. I calculate the one month return on XRE and denote it as xre_r. I regress one month XRE returns on the yields from T-bills and bonds.

A regression of xre_r on the 90 day T-bill yield produces the following results.

xre_r = 1.613 -0.365 tbill

The estimated coefficient is negative indicating that a 1% increase the tbill yield reduces monthly returns by 0.365%. The sign of this coefficient is as expected, negative, but the estimated coefficient is not statistically significant at conventional levels. The R squared for this regression is 0.0115. Not much going on here.

A regression of xre_r on the 10 year bond yield produces the following results.

xre_r = 1.239 -0.105 bond

As expected the estimated coefficient on the 10 year bond variable is negative. This estimated coefficient is not, however, statistically significant at conventional levels of significance.The R squared from this regression is 0.0005. This is even lower than in the T-bill regression.

On the face of it, there does not seem to be too much sensitivity of REITs to movements in interest rates. Another possibility is that the relationship between XRE and interest rates is time varying. The regression results reported above assume that the coefficient on the interest rate variable is constant over the sample period. This may not be the case, in which case, a time varying beta approach may be more informative. To investigate this I used a rolling window analysis to estimate the coefficient on the T-bill variable using a rolling window regression approach with a fixed window length of 60 observations.

Whoa! Now here is something interesting. Up until the beginning of 2012, the sensitivity of XRE to the T-bill yield was fairly constant. Starting in early 2012, however, the relationship changed with REITs becoming more sensitive to interest rates. The most recent value of the estimated coefficient on the T-bill variable is -5.41. This means that a 1% increase in the T-bill yield decreases monthly returns on XRE by 5.41%. For most of the sample period, REIT investors were not too sensitive to movements in the 90 day T-bill rates. That has clearly changed over the past year. REIT investors have become much more concerned with rising interest rates. With falling REIT prices, the yields on REITs will eventually start to look good on a risk adjusted basis. Given the large sell off in REITs, however, this could take some time.

Here is how Canadian 3 month T-bills and 10 year government bonds have performed. It seems reasonable to expect that REITs are negatively correlated with T-bill or bond yields, since increases in fixed income yields offer competitive less risky alternatives to investing in REITs. These falling yields have helped push the price of XRE higher.

I collected monthly data on XRE, 90 day T-bill yields, and the yield on 10 year government of Canada bonds. I calculate the one month return on XRE and denote it as xre_r. I regress one month XRE returns on the yields from T-bills and bonds.

A regression of xre_r on the 90 day T-bill yield produces the following results.

xre_r = 1.613 -0.365 tbill

The estimated coefficient is negative indicating that a 1% increase the tbill yield reduces monthly returns by 0.365%. The sign of this coefficient is as expected, negative, but the estimated coefficient is not statistically significant at conventional levels. The R squared for this regression is 0.0115. Not much going on here.

A regression of xre_r on the 10 year bond yield produces the following results.

xre_r = 1.239 -0.105 bond

As expected the estimated coefficient on the 10 year bond variable is negative. This estimated coefficient is not, however, statistically significant at conventional levels of significance.The R squared from this regression is 0.0005. This is even lower than in the T-bill regression.

On the face of it, there does not seem to be too much sensitivity of REITs to movements in interest rates. Another possibility is that the relationship between XRE and interest rates is time varying. The regression results reported above assume that the coefficient on the interest rate variable is constant over the sample period. This may not be the case, in which case, a time varying beta approach may be more informative. To investigate this I used a rolling window analysis to estimate the coefficient on the T-bill variable using a rolling window regression approach with a fixed window length of 60 observations.

Whoa! Now here is something interesting. Up until the beginning of 2012, the sensitivity of XRE to the T-bill yield was fairly constant. Starting in early 2012, however, the relationship changed with REITs becoming more sensitive to interest rates. The most recent value of the estimated coefficient on the T-bill variable is -5.41. This means that a 1% increase in the T-bill yield decreases monthly returns on XRE by 5.41%. For most of the sample period, REIT investors were not too sensitive to movements in the 90 day T-bill rates. That has clearly changed over the past year. REIT investors have become much more concerned with rising interest rates. With falling REIT prices, the yields on REITs will eventually start to look good on a risk adjusted basis. Given the large sell off in REITs, however, this could take some time.

Friday, 19 April 2013

Seach Interest in the Tar Sands Peaked in 2006

Here are some charts showing how Google searches of terms tar sands, oil sands, and fracking compare.

On a regional basis, searches for terms like tar sands or oil sands are mostly from Canada.

This is a bit of a surprise, since the assumption here in Canada is that the world is very interested in the tar sands. It appears that there is much more interest in fracking.

What Google Trends is Saying About Renewable Energy and Fracking

Google searches of the term "renewable energy" peaked in March of 2009. Since then, Google searches for renewable energy having been trending downwards. In comparison, searches of the term "fracking" really started to take off in late 2010 and hit a record high in February of this year.

Here is a regional map of searches for renewable energy. Searchers in Europe, Africa, India, and Australia have shown strong interest in renewable energy. Here is a regional map of searches for fracking. Notice how much search interest there is in this term coming from the US and South Africa.

Here is a regional map of searches for renewable energy. Searchers in Europe, Africa, India, and Australia have shown strong interest in renewable energy. Here is a regional map of searches for fracking. Notice how much search interest there is in this term coming from the US and South Africa.

Subscribe to:

Posts (Atom)