Showing posts with label debt. Show all posts

Showing posts with label debt. Show all posts

Wednesday, 12 February 2014

The European Debt Crisis

Here is a great video presentation of the European Debt Crisis.

Sunday, 13 November 2011

Game Theory Tells Us the Euro is Dead!

Tyler Durden has a very nice post showing how game theory can be used to analyze the current euro zone disaster (see here). This is a very interesting must read for followers of game theory. Here is the game. Question: is there a dominant strategy?

Friday, 11 November 2011

PIIGS and their Bond Yields

The yield spread on 10 year Greek bonds over 10 year German bunds has attracted a lot of attention of late, and with good reason now that the yield on Greek bond yields is 32% higher than on German bunds. The spread between Portugal 10 year bonds and German 10 year bunds is also in double digits. The spreads on Italian and Spanish debt are around 5%. Not too shocking except that, in the case of Italy, Italy has $2.6 trillion dollars of debt outstanding (which is more than all of the other PIIGS combined). In order to save the euro, the European Central Bank is going to have to crank up the printing presses to print massive amounts of euros although German's and any students of the Weimar Republic would resist this.

Friday, 4 November 2011

Big Government Defaults Since 1999

Here is a nice chart showing economic growth before and after some big government defaults.The economies of Argentina, Uruguay, Russia and Indonesia grew faster in the years after the default. An orderly default allows countries to wipe the sleight clean and re-organize economic priorities in an orderly manner. Default should only used as the last option, but sometimes it is a necessary step to take for countries to rebuild themselves. How the situation in Greece plays out is currently an unanswered question but financial markets have already priced in a partial default with the expectation that holders of Greek government debt are likely to get between 10 and 20 cents on the dollar. This is much lower than the 50% writedown that EU leaders recently agreed to.

Thursday, 8 September 2011

Ontario's Debt

Ontario's debt and slow economic growth are two issues that voters might be thinking about in this election year.

From Livio Di Matteo's site, here is a link to a good article on Ontario's 244.7 billion dollars of debt.One can make the argument that debt is not that big of a concern when it is held by domestic residents.

"Ontario accounts for approximately

My preference would be to focus on increasing economic growth and worry about the debt later.

From Livio Di Matteo's site, here is a link to a good article on Ontario's 244.7 billion dollars of debt.One can make the argument that debt is not that big of a concern when it is held by domestic residents.

According to the Ontario government,

"Ontario accounts for approximately

38 per cent of Canada's GDP. In 2010, Ontario's GDP was approximately

C$614 billion. With 13.2 million or approximately 39 per cent of the Canadian population, Ontario is Canada’s most populous province. Ontario is centrally located for both the Canadian and United States markets."

Here is a link to a fact sheet on Ontario's economy. Financial services and professional services make up 44% of Ontario's GDP. Manufacturing makes up a smaller percentage of Ontario's GDP.

Reducing debt is however, going to be a problem since Ontario's GDP is forecast to grow at around 2.5% per year over the next three years and the unemployment rate is forecast to average 7.7% over the next three years. Reducing debt requires cutting government spending and increasing taxes: neither of which is popular during an election year or when the economy is growing slowly.

On the expenditure side, health and education are expected to account for 57% of government spending in 2011-2012. There is not much room for cutting expenditures.

In 2009-2010, tax revenue made up 67.8% of Ontario's government revenue. Here is the forecast for 2011-2012.

On the tax side, personal income taxes and sales tax account for 62% of tax collection. Here is a link showing where the tax revenue comes from.

Personal income taxes accounted for 36% of Ontario's tax collection while corporate taxes accounted for 9% of tax collection.

My preference would be to focus on increasing economic growth and worry about the debt later.

Wednesday, 10 August 2011

Debt Crisis Phone In

On Monday August 8, I was on Ontario Today talking about the current global financial crisis. Here is a link to the podcast.

Monday, 8 August 2011

Can the US Ever Pay Off its Debt?

According to this blog post, the answer is, no. At 14 plus trillion dollars it really is not possible to pay off the debt. Moreover, including future liabilities like social security, medical costs and pensions drives the debt load into the stratosphere somewhere between 60 and 70 trillion dollars. In comparison, the entire stock of assets in the US is estimated between 40 and 50 trillion dollars. This post makes me want to re-read the book "The Creature From Jekyll Island". This is an interesting book that details the creation of the US Federal Reserve.

In Europe, the ECB is faced with the task of coming up with several trillion dollars over the next few years to keep the PIIGS from being slaughtered. Money, that will keep these economies afloat for a few years but will ultimately never be paid back in full. With the American and European debt situations so mind boggling, perhaps debt repudiation is the answer. The alternatives (do nothing or do small patch work debt deals) may well lead to a global depression. As this chart below shows, the biggest problem in America right now is lack of jobs. Japan has shown how it is possible for a major economic powerhouse to sustain two decades of lost economic opportunity with high debt loads and very slow economic growth.. It is now time for the US to decide which path to follow.

In Europe, the ECB is faced with the task of coming up with several trillion dollars over the next few years to keep the PIIGS from being slaughtered. Money, that will keep these economies afloat for a few years but will ultimately never be paid back in full. With the American and European debt situations so mind boggling, perhaps debt repudiation is the answer. The alternatives (do nothing or do small patch work debt deals) may well lead to a global depression. As this chart below shows, the biggest problem in America right now is lack of jobs. Japan has shown how it is possible for a major economic powerhouse to sustain two decades of lost economic opportunity with high debt loads and very slow economic growth.. It is now time for the US to decide which path to follow.

Sunday, 7 August 2011

Country Debt Ratings

Courtesy of Thomson Reuters, here is a map of Standard & Poor's sovereign debt ratings by country. The US has just lost its triple A rating and joins China and Spain with a double A plus rating. Notice that Canada belongs to a relatively elite group of countries with a triple A rating.

As for the US downgrade, here are some bright moments from other countries. Canada lost its AAA rating in April 1993 when the Canadian Bond Rating Service downgraded the country's crediting rating from triple-A to AA-plus. The year after, Canadian stocks gained more than 15%. The Tokyo stock market climbed more than 25% in the 12 months after Moody's downgraded Japan in November 1998.

Felix Solomon has an interesting post on soverign debt ratings as well as a link in his article to all S&P sovereign ratings actions since 1975. A very interesting read.

As for the US downgrade, here are some bright moments from other countries. Canada lost its AAA rating in April 1993 when the Canadian Bond Rating Service downgraded the country's crediting rating from triple-A to AA-plus. The year after, Canadian stocks gained more than 15%. The Tokyo stock market climbed more than 25% in the 12 months after Moody's downgraded Japan in November 1998.

Felix Solomon has an interesting post on soverign debt ratings as well as a link in his article to all S&P sovereign ratings actions since 1975. A very interesting read.

Wednesday, 27 July 2011

Here is What Happens if there is no Deal on the US Debt Ceiling

According to David Walker -- the former Comptroller General of the United States and head of the Government Accountability Office, here is what happens if the federal government cannot reach a deal.

1. $4 billion-plus a day will come out of the economy.

2. Government and civilian military workers will be laid off temporarily. That will result in penalties for late payment, to be paid by taxpayers.

3. Social security payments will be delayed.

4. No one knows how bad the reaction will be, but Walker is confident it will be negative for the stock and bond markets and the economy.

5. Interest rates will rise. For every 1% rise in interest rates, taxpayers will be on the hook for an additional $150 billion in debt payments.

1. $4 billion-plus a day will come out of the economy.

2. Government and civilian military workers will be laid off temporarily. That will result in penalties for late payment, to be paid by taxpayers.

3. Social security payments will be delayed.

4. No one knows how bad the reaction will be, but Walker is confident it will be negative for the stock and bond markets and the economy.

5. Interest rates will rise. For every 1% rise in interest rates, taxpayers will be on the hook for an additional $150 billion in debt payments.

The Effect of A US Downgrade On Stocks

For those of you trying to figure out what the effect of a US debt downgrade would mean for stocks, here is a calculation from Contrarian Musings showing that a debt down grade would lead to a 6.5% drop in US stocks. Intrade Prediction Markets indicates that there is currently a 60% chance that Standard and Poor's will downgrade US debt from its current triple A rating.

Monday, 25 July 2011

Here is Who Owns the $14 Trillion US Debt

While Washington is bogged down in how to raise the US debt ceiling, people around the world are asking questions like "who owns this debt?". The Atlantic has a graph answering this question. More than half of the total national debt is owed to the US Federal Reserve. Debt owed to a country's own citizens is not as big a problem as debt owed to foreigners.

Saturday, 23 July 2011

More Aid to Greece

The BBC has a good story summarizing what is known about the latest aid package to Greece. The story also has a link to the original EU press release which is a short 4 page document short on specifics.

According to the BBC story:

"Debt relief

The Institute of International Finance - a global trade body representing big banks and other major lenders - said the planned debt restructuring would target participation by 90% of Greece's private sector lenders.

French President Nicolas Sarkozy said private lenders will contribute a total of 135bn euros of financing to Greece.

The plan is expected to provide some 50bn euros of debt relief to Greece.

Three of the four options offered to lenders to swap or relend existing debts would extend Greece's repayment terms by 30 years, while the fourth would do so by 15 years.

They all offer a much lower interest rate than Greece's current 15%-25% cost of borrowing in financial markets.

Two of the options would also involve "haircuts" - reducing the principal amount of debt Greece has to repay.

The terms of the deal imply a loss to Greece's lenders equivalent to 21% of the market value of their debts, said the IIF."

This sounds like a short-run band aid solution to buy some time before a new round of financing is required. The voluntary target participation by 90% of Greece's private sector lenders is a way to stop credit default swap (CDS) payouts. Which brings up an interesting question. What then is the point of purchasing CDS if payouts can be voluntarily suspended?

While the aid package is designed to soften the blow of Greece's current debt situation, it is unlikely that the austerity measures imposed in Greece are going to do anything except plunge the economy into a deep and long recession (see here). In Greece, tax collection is too low (or too lax, since tax evasion is prominent) relative to government spending. Realistically, the EU needs to consider the option of allowing Greece to default on their debt obligations and a possible strategy for allowing Greece to exit the Euro.

Spiegel Online International has really good coverage of the European debt crisis.

According to the BBC story:

"Debt relief

The Institute of International Finance - a global trade body representing big banks and other major lenders - said the planned debt restructuring would target participation by 90% of Greece's private sector lenders.

French President Nicolas Sarkozy said private lenders will contribute a total of 135bn euros of financing to Greece.

The plan is expected to provide some 50bn euros of debt relief to Greece.

Three of the four options offered to lenders to swap or relend existing debts would extend Greece's repayment terms by 30 years, while the fourth would do so by 15 years.

They all offer a much lower interest rate than Greece's current 15%-25% cost of borrowing in financial markets.

Two of the options would also involve "haircuts" - reducing the principal amount of debt Greece has to repay.

The terms of the deal imply a loss to Greece's lenders equivalent to 21% of the market value of their debts, said the IIF."

This sounds like a short-run band aid solution to buy some time before a new round of financing is required. The voluntary target participation by 90% of Greece's private sector lenders is a way to stop credit default swap (CDS) payouts. Which brings up an interesting question. What then is the point of purchasing CDS if payouts can be voluntarily suspended?

While the aid package is designed to soften the blow of Greece's current debt situation, it is unlikely that the austerity measures imposed in Greece are going to do anything except plunge the economy into a deep and long recession (see here). In Greece, tax collection is too low (or too lax, since tax evasion is prominent) relative to government spending. Realistically, the EU needs to consider the option of allowing Greece to default on their debt obligations and a possible strategy for allowing Greece to exit the Euro.

Spiegel Online International has really good coverage of the European debt crisis.

Tuesday, 19 July 2011

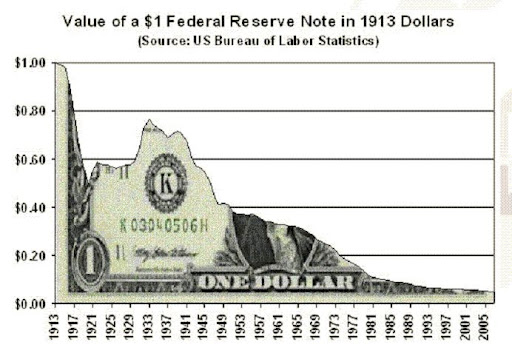

Printing Money and the Value of $1 in 1913 Dollars

Washington's Blog has a nice article on comments Ron Paul made about US debt and how printing money reduces purchasing power. Inflation erodes the real value of investments.Here is an example. In 1913 when the Federal Reserve Central Bank was established, gold was valued at $20.67 per ounce. Today, in paper fiat units, gold is valued at around $1,500 per ounce. So if we divide $20.67 by $1,500, we get 0.01378 minus 1 = – 0.9862 X 100 = – 98.6 percent. This calculation shows that since 1913, US fiat money has lost 98.6% of its value since 1913.

This chart in particle caught my eye.

Monday, 4 July 2011

Greek Debt Troubles

Well this is interesting. Rolling over debt is not what S&P considers to be enough to address Greece's debt problems.

"A leading credit ratings agency warned Monday that Greece would be considered to be in default if banks rolled over their holdings in the country's debt as proposed by a French plan."

French banks are heavily exposed to Greek debt and are no doubt looking for a quick short-term fix to their problems. French banks hold about $21 billion of Greek sovereign debt, while Germany holds about $23 billion.This is not going to play well with traders of the Euro.

"A leading credit ratings agency warned Monday that Greece would be considered to be in default if banks rolled over their holdings in the country's debt as proposed by a French plan."

French banks are heavily exposed to Greek debt and are no doubt looking for a quick short-term fix to their problems. French banks hold about $21 billion of Greek sovereign debt, while Germany holds about $23 billion.This is not going to play well with traders of the Euro.

Tuesday, 28 June 2011

Greek Austerity Measures

Courtesy of the BBC here is the latest information on the austerity measures that the Greek government needs to pass. In short, the plan is proposing massive tax increases and drastic spending cuts.

Subscribe to:

Posts (Atom)