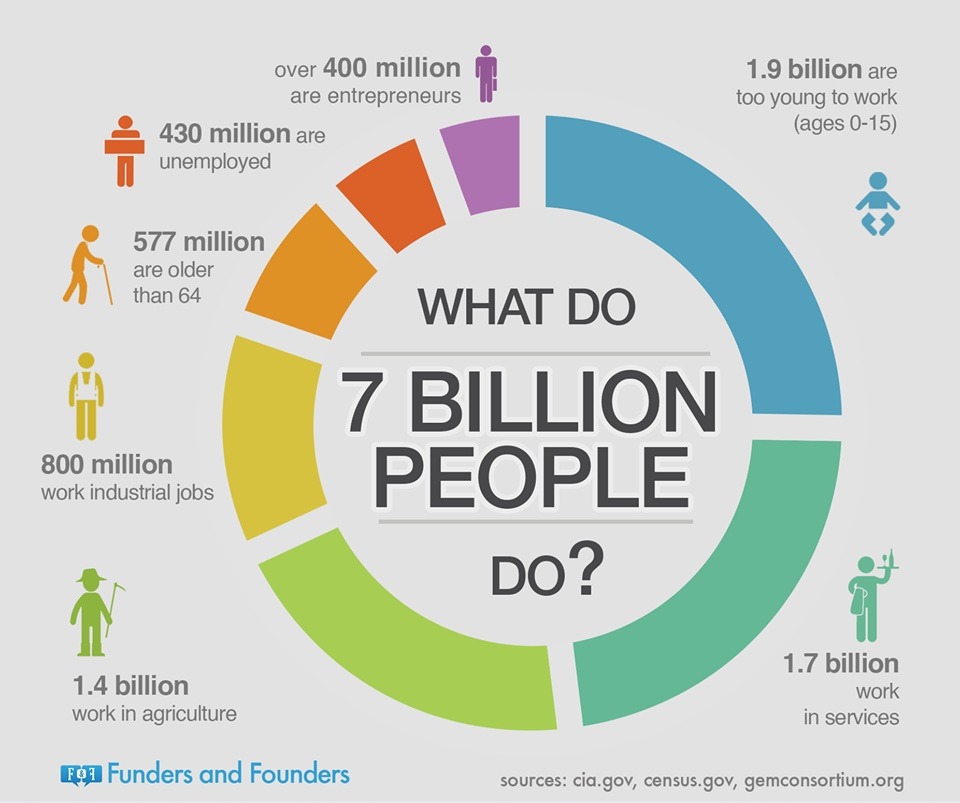

The majority of the global work force works in services. There are fewer entrepreneurs than unemployed.

Showing posts with label labour and unemployment. Show all posts

Showing posts with label labour and unemployment. Show all posts

Wednesday, 31 July 2013

Wednesday, 9 January 2013

Jobs and Unemployment in 2012

Since I have an undergraduate degree in physics and astronomy, I found this story about jobs with the highest and lowest unemployment rates in 2012 and the enclosed table particularly interesting.

Saturday, 24 November 2012

Business Investment as a Leading Indicator of Employment

For a slightly more optimistic perspective on the US economy and financial markets, here is a chart showing how US business investment and US employment have performed over the past ten years.

Notice how business investment tends to peak and trough before employment. This chart indicates that business investment may be a useful leading indicator of employment. For a closer analysis, I downloaded the data and constructed a relatively simple autoregressive distributed lag (ARDL) model with 2 lags on each of investment and employment. For modelling purposes I took the natural logarithm of each variable. The resulting regression output looks like this:

Tests on the residuals and squared residuals indicate that serial correlation is not a problem. Since the variables are measured in natural logarithms, the coefficient estimates can be interpreted as elasticities. The short-run elasticity of employment with respect to business investment is 0.053% while the long-run elasticity is 0.160%. In the short-run, a 1% increase in business investment increases employment by 0.053%, while in the long-run, a 1% increase in business investment increases employment by 0.160%.

Here is a plot of the fitted values and residuals. Notice how closely the fitted values track the actual values.

Since business investment is currently trending upwards, this indicates higher employment (and hopefully lower unemployment) which is good for the economy and financial markets.

Notice how business investment tends to peak and trough before employment. This chart indicates that business investment may be a useful leading indicator of employment. For a closer analysis, I downloaded the data and constructed a relatively simple autoregressive distributed lag (ARDL) model with 2 lags on each of investment and employment. For modelling purposes I took the natural logarithm of each variable. The resulting regression output looks like this:

Tests on the residuals and squared residuals indicate that serial correlation is not a problem. Since the variables are measured in natural logarithms, the coefficient estimates can be interpreted as elasticities. The short-run elasticity of employment with respect to business investment is 0.053% while the long-run elasticity is 0.160%. In the short-run, a 1% increase in business investment increases employment by 0.053%, while in the long-run, a 1% increase in business investment increases employment by 0.160%.

Here is a plot of the fitted values and residuals. Notice how closely the fitted values track the actual values.

Since business investment is currently trending upwards, this indicates higher employment (and hopefully lower unemployment) which is good for the economy and financial markets.

Subscribe to:

Posts (Atom)