To international investors, investing in Canadian equities amounts to investing in banks and natural resource companies. Currently, the largest sectors on the TSX (in terms of market capitalization) are financial services (32%), energy (25%) and raw materials (18%). These three sectors account for a whopping 75% of the TSX. The performance of the TSX depends, to a large extent, on the demand for natural resources.

Here is a chart comparing Canadian equities with equity markets in Europe and the Far East (EAFE), emerging markets (EM) and the United States (USA). The data are in US dollars, include dividends and cover the period January 2002 to November 2012. Notice that each equity index tends to peak and trough around the same times but in terms of performance, emerging markets and Canada are the two big leaders.

In order to determine how well movements in Canadian stock prices can be explained by movements in other major equity markets, I fit an autoregressive distributed lag (ARDL) model. Here are the regression results.

The model fits well. Residual diagnostics (not shown) indicate serial correlation in the residuals or squared residuals is not a problem. The plot of actual values vs fitted values shows how tight the fit is. The variables are transformed to natural logarithms which helps to reduce the variability in the data. The natural logarithm transformation also means that the coefficient estimates can be interpreted as elasticities. The largest contemporaneous effect comes from emerging markets (estimated coefficient of 0.54 with a p value of < 0.01). The estimated coefficient on US equity markets is positive and statistically significant at 5% but 47% smaller than the estimated coefficient on emerging markets.

Emerging markets (EM) has the largest short-run elasticity. In the short-run, a 1% increase in EM stock prices increases Canada stock prices by 0.54%. Emerging markets also has the largest long-run elasticity. In the long-run, a 1% increase in emerging market stock prices increases Canadian stock prices by 0.76%. Long-run EAFE and USA elasticities are much smaller than the long-run EM elasticity.

The empirical model fits well and provides support for the hypothesis that Canadian stock prices are more influenced by movements in emerging market stock prices than movements in US stock prices or movements in other developed markets.

Showing posts with label commodities. Show all posts

Showing posts with label commodities. Show all posts

Thursday, 20 December 2012

Thursday, 29 November 2012

A Sovereign Wealth Fund for Canada

The Canadian International Council has recently released a new report entitled “Nine Habits of Highly Effective Resource Economies.” (see here for the report). According to the report, Canada is flush with valuable natural resources but lacks the capabilities and foresight to exploit these natural resources in a sustained value enhancing manner that will create long term growth and prosperity for Canadians. Canada's exploitation of natural resources can be nicely categorized as "rip and ship".

The details of the nine habits are in the report, but here is a listing of the nine habits.

Foreign ownership of Canada's natural resources is one area that is particularly worrisome. In general, Canadian natural resource companies grow to a reasonably large size and, rather than striving to become global leaders, choose instead to sell out to a foreign competitor. A recent example of the sell to foreigners approach is China’s state-owned CNOOC Ltd.$15-billion bid for Calgary-based oil producer Nexen Inc.

For a country that has a lot of natural resources, Canadian resource companies are not prominently listed among the world's biggest resource companies. Canada is the world’s top producer of potash and titanium and ranks among the top 10 producers of forest products, uranium, aluminum, natural gas, sulphur, tungsten, diamonds, asbestos, nickel, platinum, crude oil, molybdenum, zinc, and gold. With such an impressive production record, one would expect Canadian natural resource companies to rank among the biggest in the world. Potash is the world's largest potash company, but most Canadian resource companies do not rank among the global giants.

Foreign ownership is particularly evident in the Alberta tar sands where by some estimates more than two-thirds of all tar sands production in Canada is owned by foreign entities (see here). This sends a majority of the profits from oil produced from the tar sands outside of Canada. So, Canada needs a different approach if it is going to benefit from its natural resource wealth.

A sovereign wealth fund (SWF) is one approach that Canada can expand upon. After all, Alberta has the Heritage Fund, so why not create a natural resource based sovereign wealth fund for Canada as a whole.

Here is a ranking of the world's top sovereign wealth funds. The Alberta Heritage Fund ranks 29th. Notice that Alberta's fund was started in 1976, the same year that Alaska started theirs. The Alaska fund is, however, 3 times larger than Alberta's. Australia started their fund in 2006, and look at how much money it already has. When compared against other SWFs, the Alberta Heritage Fund doesn't seem to be doing so well. A recent Toronto Star article on Norway points out that at least from Norway's perspective, Canada is a nice place with lots of natural resources, but badly managed.

Data sourced from Sovereign Wealth Fund Institute

The current situation in Canada can be described as too much foreign ownership and too low of a tax base for Canada to effectively generate wealth from its natural resources. This makes Canadian natural resources vulnerable to international rent seekers.

So what is Norway doing so well?

Norway's SWF was setup in 1990 and currently has slightly over $650 billion dollars. The fund is on track to amass $1 trillion by the end of this decade. The fund is an excellent case study on portfolio investing (see here). Norway faced foreign ownership problems in the oil business as well but they responded with a 90% marginal tax and focused on training their own citizens to be the primary source of employment in the oil and gas sector. In comparison, Alberta has a miniscule 10% royalty tax and companies working in Alberta outsource as much capital and labour as they can with the predictable result that Alberta is earning a fraction of what it should be from its valuable natural resource base. Norway is also not afraid of starring down carbon nay-Sayers. Norway recently announced that it would increase its current carbon tax on offshore oil companies by £21 to £45 per tonne of carbon. Norway also has a carbon tax imposed on the fishing industry.

Perhaps Canada needs to re-think the concept of a state owned oil company.

The details of the nine habits are in the report, but here is a listing of the nine habits.

Foreign ownership of Canada's natural resources is one area that is particularly worrisome. In general, Canadian natural resource companies grow to a reasonably large size and, rather than striving to become global leaders, choose instead to sell out to a foreign competitor. A recent example of the sell to foreigners approach is China’s state-owned CNOOC Ltd.$15-billion bid for Calgary-based oil producer Nexen Inc.

For a country that has a lot of natural resources, Canadian resource companies are not prominently listed among the world's biggest resource companies. Canada is the world’s top producer of potash and titanium and ranks among the top 10 producers of forest products, uranium, aluminum, natural gas, sulphur, tungsten, diamonds, asbestos, nickel, platinum, crude oil, molybdenum, zinc, and gold. With such an impressive production record, one would expect Canadian natural resource companies to rank among the biggest in the world. Potash is the world's largest potash company, but most Canadian resource companies do not rank among the global giants.

Foreign ownership is particularly evident in the Alberta tar sands where by some estimates more than two-thirds of all tar sands production in Canada is owned by foreign entities (see here). This sends a majority of the profits from oil produced from the tar sands outside of Canada. So, Canada needs a different approach if it is going to benefit from its natural resource wealth.

A sovereign wealth fund (SWF) is one approach that Canada can expand upon. After all, Alberta has the Heritage Fund, so why not create a natural resource based sovereign wealth fund for Canada as a whole.

Here is a ranking of the world's top sovereign wealth funds. The Alberta Heritage Fund ranks 29th. Notice that Alberta's fund was started in 1976, the same year that Alaska started theirs. The Alaska fund is, however, 3 times larger than Alberta's. Australia started their fund in 2006, and look at how much money it already has. When compared against other SWFs, the Alberta Heritage Fund doesn't seem to be doing so well. A recent Toronto Star article on Norway points out that at least from Norway's perspective, Canada is a nice place with lots of natural resources, but badly managed.

Data sourced from Sovereign Wealth Fund Institute

The current situation in Canada can be described as too much foreign ownership and too low of a tax base for Canada to effectively generate wealth from its natural resources. This makes Canadian natural resources vulnerable to international rent seekers.

So what is Norway doing so well?

Norway's SWF was setup in 1990 and currently has slightly over $650 billion dollars. The fund is on track to amass $1 trillion by the end of this decade. The fund is an excellent case study on portfolio investing (see here). Norway faced foreign ownership problems in the oil business as well but they responded with a 90% marginal tax and focused on training their own citizens to be the primary source of employment in the oil and gas sector. In comparison, Alberta has a miniscule 10% royalty tax and companies working in Alberta outsource as much capital and labour as they can with the predictable result that Alberta is earning a fraction of what it should be from its valuable natural resource base. Norway is also not afraid of starring down carbon nay-Sayers. Norway recently announced that it would increase its current carbon tax on offshore oil companies by £21 to £45 per tonne of carbon. Norway also has a carbon tax imposed on the fishing industry.

Perhaps Canada needs to re-think the concept of a state owned oil company.

Sunday, 10 June 2012

Sustainable Investing vs Wine and Gold

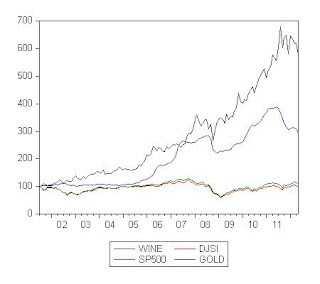

What do sustainable investments, wine and gold have in common over the past ten years? Well, for one thing, investments in wine and gold have vastly outperformed an investment in sustainable companies.Below is a chart showing the performance of wine (measured by the Live Ex Fine Wine 100 Index), sustainable equities (as measured by the Dow Jones Sustainability Index), gold (the front month futures contract on COMEX gold), and the S&P500.

Sharpe ratios show that wine has been the best investment followed closely by gold. The S&P 500 has a slightly larger Sharpe ratio then the Dow Jones Sustainability Index, but both Sharpe ratios are negative over the sample period.

To combine the concepts of sustainability and wine together, how about a sustainability wine index? An example of this would be an index that follows organic wines.

Sharpe ratios show that wine has been the best investment followed closely by gold. The S&P 500 has a slightly larger Sharpe ratio then the Dow Jones Sustainability Index, but both Sharpe ratios are negative over the sample period.

| wine | djsi | sp500 | gold | ||

| 0.79 | -0.12 | -0.06 | 0.78 |

Saturday, 26 November 2011

A High CARBS Diet for Economic Growth

Thanks to Richard Park for bringing this important new acronym to my attention. Citigroup analysts have defined a new group of countries Canada, Australia, Russia, Brazil, and South Africa (CARBS).

"

Here are how the CARBS compare on a number of different indicators.

"

What are the CARBS? They are the countries that combine very large commodity assets with high stock market liquidity. In many ways, they have exhibited similar characteristics so far over the course of the commodity cycle.The CARBS have a large share of the world's resource assets and a large share of global production of these assets. The increasing importance of resource scarcity and population growth indicates that resource exporters like the CARBS should do well in terms of economic growth.

What have they got. The five CARBS economies have some 29% of the global landmass, inhabited by only 6% of the world’s population, and are thus disproportionately important as exporters of commodities. They produce between a quarter and a half of most key commodities."

Here are how the CARBS compare on a number of different indicators.

Thursday, 1 September 2011

Comparing Emerging Economies with Developed Economies

Here is a short video from The Economist comparing emerging markets with developed economies.

Saturday, 16 July 2011

Copper Prices Ticking Up

Recently, copper prices broke well above the 200 day moving average and this may be a sign of global economic growth picking up. Copper is used in electronics, homes and infrastructure and copper price movements are often viewed by many as an indicator of global economic conditions.

For example, here is how the relationship between copper prices and emerging stock prices (as measured by VWO) has looked over the past five years. Correlation does not imply causality, but the two data series do track each other fairly closely.

For example, here is how the relationship between copper prices and emerging stock prices (as measured by VWO) has looked over the past five years. Correlation does not imply causality, but the two data series do track each other fairly closely.

Thursday, 14 July 2011

Drivers of Gold Prices

Nomura recently put out a report on on what drives gold's movement.

Their report is titled: "What drives gold?" Some of the important factors include:

Real interest rates, central bank balance sheets, Indian wedding season, and the Aussie dollar.

Here are some interesting charts from the report.

Their report is titled: "What drives gold?" Some of the important factors include:

Real interest rates, central bank balance sheets, Indian wedding season, and the Aussie dollar.

Here are some interesting charts from the report.

Subscribe to:

Posts (Atom)