Here is a chart showing how three simple investment strategies on the TSX compare. The returns are calculated from price returns (no dividends) over the period 1957 to 2011. The MA(10) switch portfolio uses a moving average trend following strategy by comparing monthly closing prices with a moving average of length ten. Buy or hold the TSX when the monthly close of the TSX is above the 10 month moving average and sell the TSX if it falls below the 10 month moving average. The seasonal switch portfolio invests in the TSX during the 6 month period November to April and then at the end of April the portfolio is sold and the money held in 3 month Treasury bills. The buy and hold strategy produces the lowest returns and highest standard deviation.The seasonal switch produces the highest returns and lowest standard deviation.

Using these average annual returns it is useful to do some future value calculations. Suppose that at the beginning of each year, an individual invested $13,500. This is done each year for 25 years. At the end of a 25 year period, the buy and hold strategy generates $733,914 while the seasonal switch portfolio generates $1,385,554. Commissions and trading fees are not included in the calculations.

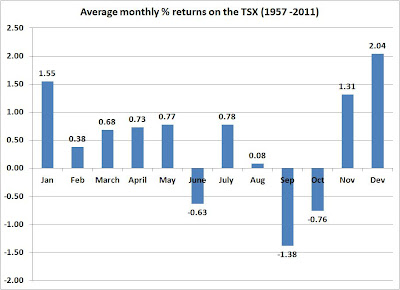

Notice that average monthly returns on the TSX do vary considerably.

No comments:

Post a Comment